2024 Bonus Depreciation Percentage. The legislation would also extend 100% bonus. The full house passed late wednesday by a 357 to 70 vote h.r.

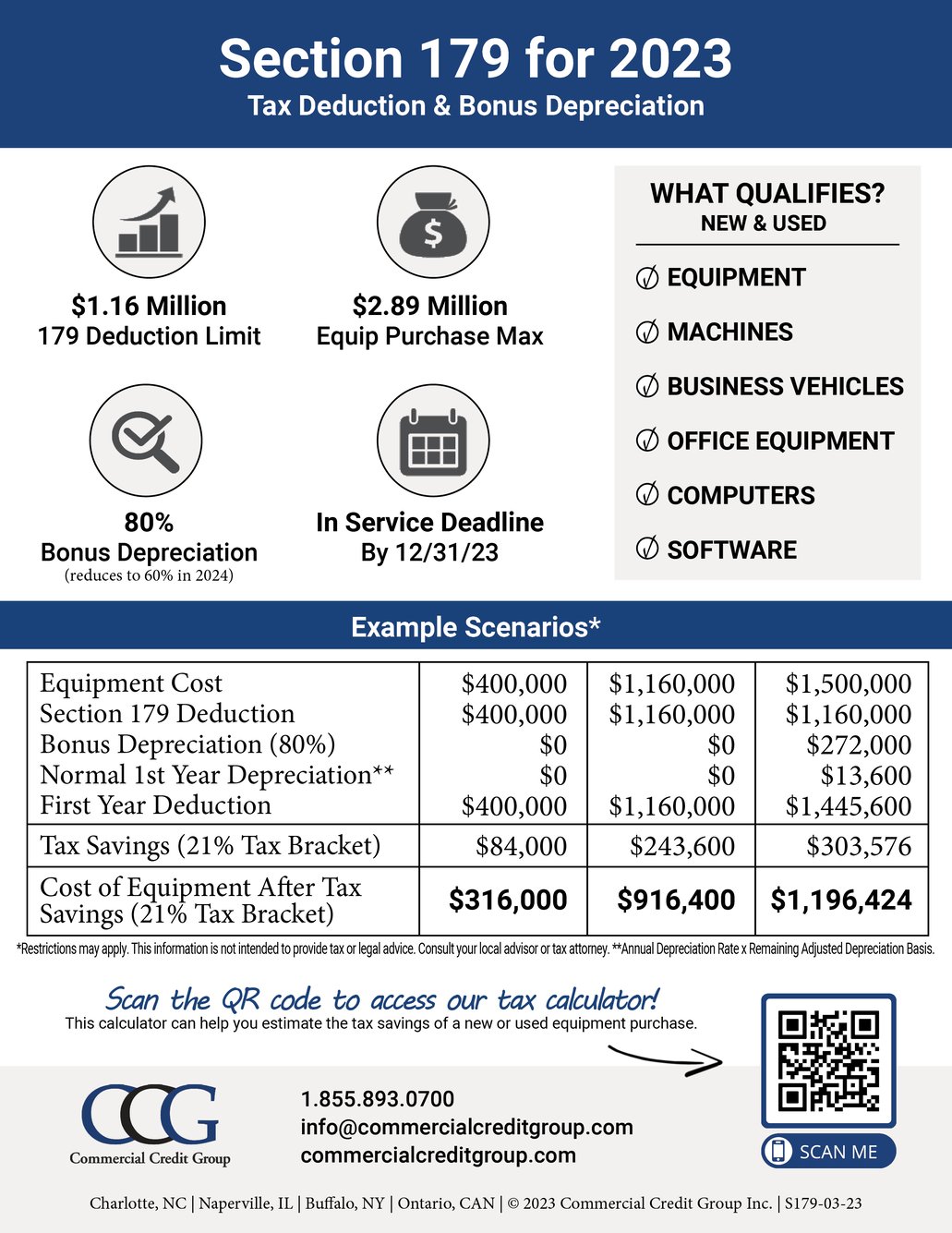

For 2024, the section 179 expense deduction is capped at $1,050,000, and the total amount of equipment purchased cannot exceed $2,620,000. In 2024, the bonus depreciation rate will drop to 60%, falling by 20% per year thereafter until it is completely phased out in 2027 (assuming congress.

The Legislation Would Also Extend 100% Bonus.

2024 has already shaped up to be a busy year for small businesses from the legislative perspective.

Bonus Depreciation Has Been Decreased By An Additional 20 Percentage Points In 2024 As Part Of The Tax Cuts And Jobs Act (Tcja).

The proposed legislation would increase the amount of the deduction to $1.29 million beginning in 2024 with the phaseout increased to $3.22 million.

Will Begin Phasing Down At The Beginning Of 2023.

Images References :

Source: taxfoundation.org

Source: taxfoundation.org

Bonus Depreciation Effects Details & Analysis Tax Foundation, For 2024, the section 179 expense deduction is capped at $1,050,000, and the total amount of equipment purchased cannot exceed $2,620,000. The proposed legislation would increase the amount of the deduction to $1.29 million beginning in 2024 with the phaseout increased to $3.22 million.

Source: www.financialfalconet.com

Source: www.financialfalconet.com

Bonus Depreciation Example and Calculations Financial, In 2018, the first full year of 100 percent bonus depreciation, corporations made. The regular depreciation rules are accelerated (relative to economic depreciation) and also confer a benefit that is estimated to result in a 13.7% tax rate for equity.

Source: blog.cashflowportal.com

Source: blog.cashflowportal.com

Bonus depreciation explained for nonreal estate professionals Cash, Additionally, there is no business. As a business owner, understanding the nuances of tax.

Source: corinneanay.blogspot.com

Source: corinneanay.blogspot.com

Allowable depreciation calculator CorinneAnay, Once the adjusted basis is calculated, apply the current bonus depreciation rate (usually a percentage) to determine the bonus. In 2024, the maximum bonus depreciation percentage will be 60%.

Source: www.commercialcreditgroup.com

Source: www.commercialcreditgroup.com

Section 179 & Bonus Depreciation Saving w/ Business Tax Deductions, Special depreciation allowance is 80% for certain qualified property acquired after september 27, 2017, and placed in service after december 31, 2022, and before. The full house passed late wednesday by a 357 to 70 vote h.r.

Source: www.financialfalconet.com

Source: www.financialfalconet.com

Bonus Depreciation Phase Out Financial, Additionally, there is no business. The bonus depreciation deduction limit for the 2023 tax year is 80% of the asset cost, down from 100% in 2022.

Source: www.educba.com

Source: www.educba.com

Bonus Depreciation Definition, Examples, Characteristics, Bonus rate is 40% january 1 st,. The proposed legislation would increase the amount of the deduction to $1.29 million beginning in 2024 with the phaseout increased to $3.22 million.

Source: www.financialfalconet.com

Source: www.financialfalconet.com

How to calculate bonus depreciation Financial, Once the adjusted basis is calculated, apply the current bonus depreciation rate (usually a percentage) to determine the bonus. For 2024, the section 179 expense deduction is capped at $1,050,000, and the total amount of equipment purchased cannot exceed $2,620,000.

Source: www.fool.com

Source: www.fool.com

What Is Bonus Depreciation A Small Business Guide, In 2024, the maximum bonus depreciation percentage will be 60%. The bonus depreciation deduction limit for the 2023 tax year is 80% of the asset cost, down from 100% in 2022.

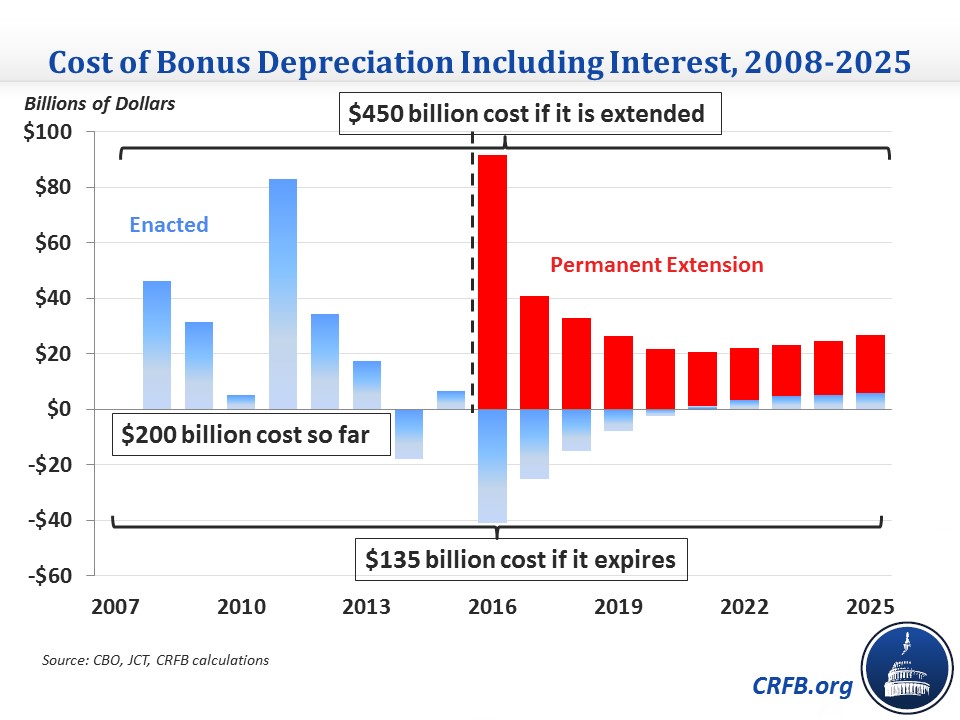

Source: www.crfb.org

Source: www.crfb.org

Bonus Depreciation Has Cost Over 200 Billion So Far and Could Cost, Bonus depreciation has been decreased by an additional 20 percentage points in 2024 as part of the tax cuts and jobs act (tcja). The irs has issued guidance that allows qualified improvement property placed in service after september 27, 2017 and before january 1, 2018, to qualify for.

The Regular Depreciation Rules Are Accelerated (Relative To Economic Depreciation) And Also Confer A Benefit That Is Estimated To Result In A 13.7% Tax Rate For Equity.

2024 has already shaped up to be a busy year for small businesses from the legislative perspective.

The Full House Passed Late Wednesday By A 357 To 70 Vote H.r.

Will begin phasing down at the beginning of 2023.